Net present value of cash flows

In this formula cash flows refer to the flow during a particular period or a future payment. Present value Expected Cash Flow 1Discount RateNumber of periods Thus for year one the math would look like this.

Net Present Value Npv Vs Internal Rate Of Return Irr Acca Exam Investing Exam Net

NPV is a favorite of most capital budget planners because it provides results in dollar value and is a more accurate predictor of an investments profitability.

. Calculating the net present value is also used to compare different investment properties. Total net cash flows less investment. The present value of a cash flow depends on the interval of time between now and the cash flow.

In simple terms NPV can be defined as the present value of future cash flows less the initial investment cost. The disadvantages of the payback approach include ____. It also depends on the discount rate.

In short the NPV formula is the value of todays expected cash. To calculate net present value add up the present value of all future cash flows. 25 in 1 year is worth 2174 right now.

It provides a method for evaluating and comparing capital projects or financial products with cash flows spread over time as in loans investments payouts from insurance co. Difference between revenue and expenses. Return to Top Net Present Value Calculator.

The net present value NPV function is used to discount all cash flows using an annual nominal interest rate that is supplied. Therefore there is no difference between cash inflows and cash outflows. The net present value calculation subtracts the discounted cash flow value from the initial cost of investment.

Net present value NPV is a capital budgeting technique used to estimate the current value of the future cash flows a proposed project or investment will generate. The timing and amount of cash flows can be uneven in the real world. The money earned on the investment is less than the.

Discount future cash flows using npv formula. Present value of future net cash flows. 50 in 2 years is worth 3781 right now.

NPV PV of future cash flows. Both present value and net present value use discounted cash flows to estimate. Net present value NPV is the value of a series of cash flows over the entire life of a project discounted to the present.

NPV is greater than zero which means your desired rate of return is achieved. Such cash flows are termed as uneven or irregular. If the net present value is positive it may be a good investment opportunity because it could provide you a return.

Enter the cash flows using CFj and Nj. The cash flows in net present value analysis are discounted for two main reasons 1 to adjust for the risk of an investment opportunity and 2 to account for the time value of money TVM. Present Value of Uneven Cash Flows.

The first point to adjust for risk is necessary because not all businesses projects or investment opportunities have the same level of risk. NPV 4545 3306 42074 25000 24925. The process gets cumbersome if you have numerous cash flows.

The net present value represents the a. Ad QuickBooks Financial Software. We can also say that the cash flows that dont adhere to the principles of annuity are uneven cash flows.

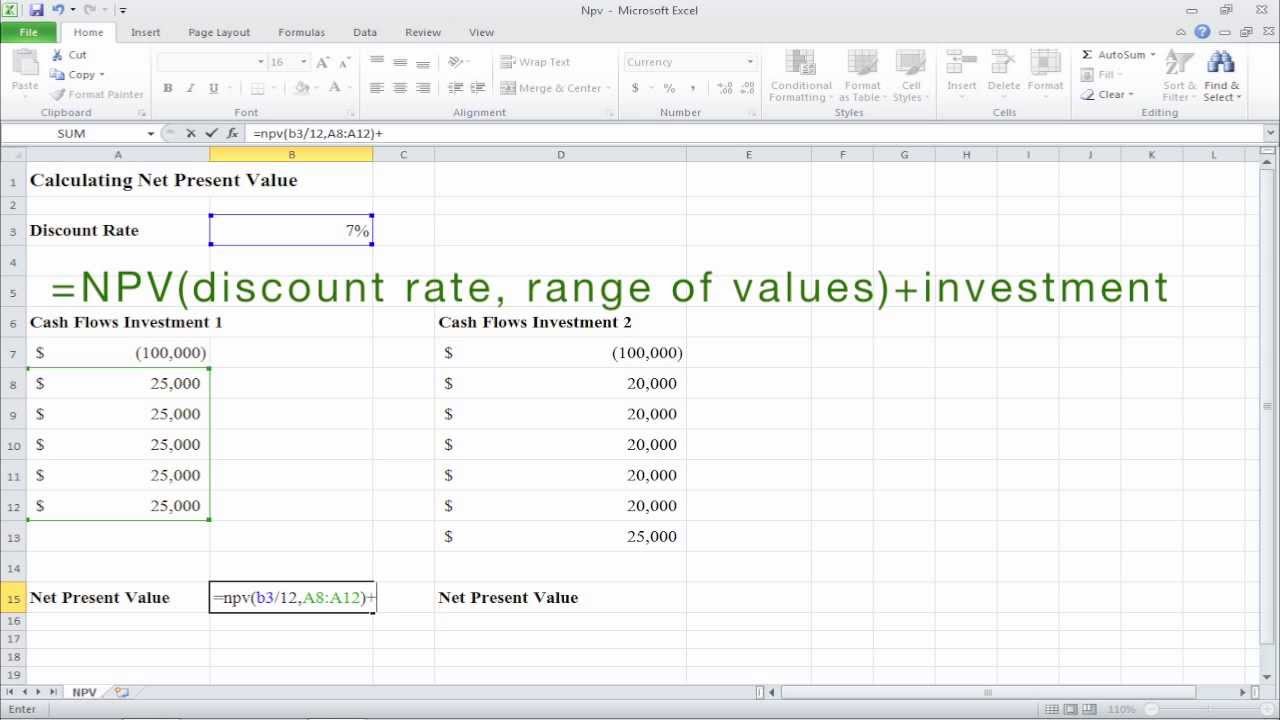

Store the annual nominal interest rate in IYR and press SHIFT then NPV. Net present value is defined as the present value of the expected future cash flows less the initial cost of the investmentthe NPV function in spreadsheets doesnt really calculate NPV. Present Value is calculated using the formula given below.

First we calculate the present value pv of each cash flow. NPV 0 - The present value of cash flows is more than the present value of cash outflows. Is the difference between the present value of cash inflows and the present.

Follow us on twitter. NPV 0 - The present value of cash inflows is less than the present value of cash outflows. Payback fails to consider the investment.

NPV calculates the net present value NPV of an investment using a discount rate and a series of future cash flows. Rated the 1 Accounting Solution. Net Present Value 8001502 The net present value of this example can be shown in the formula When solving for the NPV of the formula this new project would be estimated to be a valuable venture.

Press SHIFT then C ALL and store the number of periods per year in PYR. NPV accounts for the time value of money. 15209 in 3 years is worth 100 right now.

PV can be calculated in excel with the formula PVrate nper pmt fv type. We can check this. The net present value NPV or net present worth NPW applies to a series of cash flows occurring at different times.

Net present value is the difference between the present value of cash inflows and cash outflows over a period of time. Instead despite the word net the NPV function is really just a. NPV Cash Flow n 1 Discount Rate n Note that n is the periodic cash flow.

The NPV function simply calculates the present value of a series of future cash flows. Its easiest to calculate NPV with a spreadsheet or calculator. Present value of future net cash flows less the investment.

The money earned on the investment is equal to the money invested. For example if the cash flows of a company are 50 50 40 70 and 70 these are uneven cash flows. If its negative it may not be a good investment because the asset or project could lose you money.

All cash flows of. Cash flows1ri net present value. Next we sum these values.

Present value 50 1 101 Present value 50 1101 Present. The r symbolizes the discount rate or interest rate and the i stands for the period or number of periods during which the cash flow occurs. The following table provides each years cash flow and the present value of each cash flow.

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Cash Flow Basics How To Manage Analyze And Report Cash Flow Cash Flow Statement Positive Cash Flow Cash Flow

What Is Net Present Value Business Valuation Time Value Of Money Personalized Learning

Npv Irr Calculator Template Excel Template Calculate Net Present Value Internal Rate Of Return In 2022 Excel Templates Excel Tutorials Excel

How To Calculate Net Present Value Npv In Excel Youtube Accounting Basics Financial Analysis Calculator

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

Npv Net Present Value In 60 Seconds Go Ahead And Repin Accounting Basics Business Valuation Investing

Net Present Value Npv Financial Literacy Lessons Cash Flow Statement Accounting Education

Decision Making Using Npv Decision Making Investing Flow Chart

Disadvantages Of Using Net Present Value Business Valuation Corporate Training Financial Analyst

Net Present Value Template Download Free Excel Template Excel Templates Templates Business Template

Cash Flow Chart Template Elegant Professional Net Present Value Calculator Excel Template Flow Chart Template Invoice Template Flow Chart

Npv Calculator Calculate And Learn About Discounted Cash Flows

Calculate Npv In Excel Net Present Value Formula Excel Excel Hacks Formula

Profitability Index Formula Calculator Excel Template Regarding Net Present Value Excel Template Excel Templates Agenda Template Meeting Agenda Template

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Get T Cash Flow Calculator Financial Decisions